Blog Details

26 Sep 2023

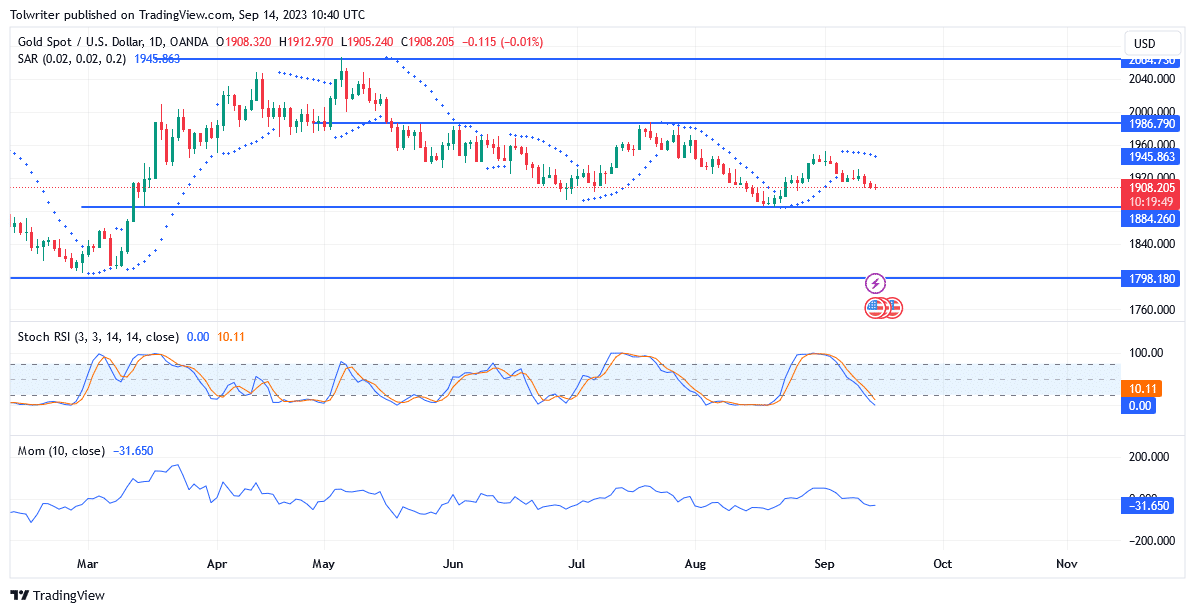

Gold (XAUUSD) Is Ready To Level Down To The 1884.260 Market Zone

Market Analysis: September 18

Gold (XAUUSD) is ready to level down to the 1884.260 market zone. Gold has been a battleground for buyers and sellers in recent times. Despite several attempts by sellers, they have not gained enough momentum to breach the crucial 1884.260 level.

On the flip side, buyers have struggled to reach the 1986.790 order level. This tug-of-war has resulted in gold being trapped in a ranging zone for a significant portion of this year. The price has been oscillating between 1986.790 and 1884.260 in important zones.

Gold (XAUUSD) Key Zones

Resistance Levels: 2004.730, 1986.790

Support Levels: 1884.260, 1798.180

Gold (XAUUSD) Long-Term Trend: Bullish

This standoff in the market began when sellers successfully reversed the price from the significant 2004.730 level. Now, traders are closely watching the price action, hoping to see a breakout from this key level.

The Stochastic Oscillator RSI (Relative Strength Index), is currently showing signs of bearish strength. This is a critical signal for traders, indicating a potential shift in market sentiment. Sellers are now prioritizing the breach of the 1884.260 key level, as failing to do so could signify a change in the market’s focus. In such a scenario, gold might revert to its ranging behavior, leaving traders in a state of uncertainty.

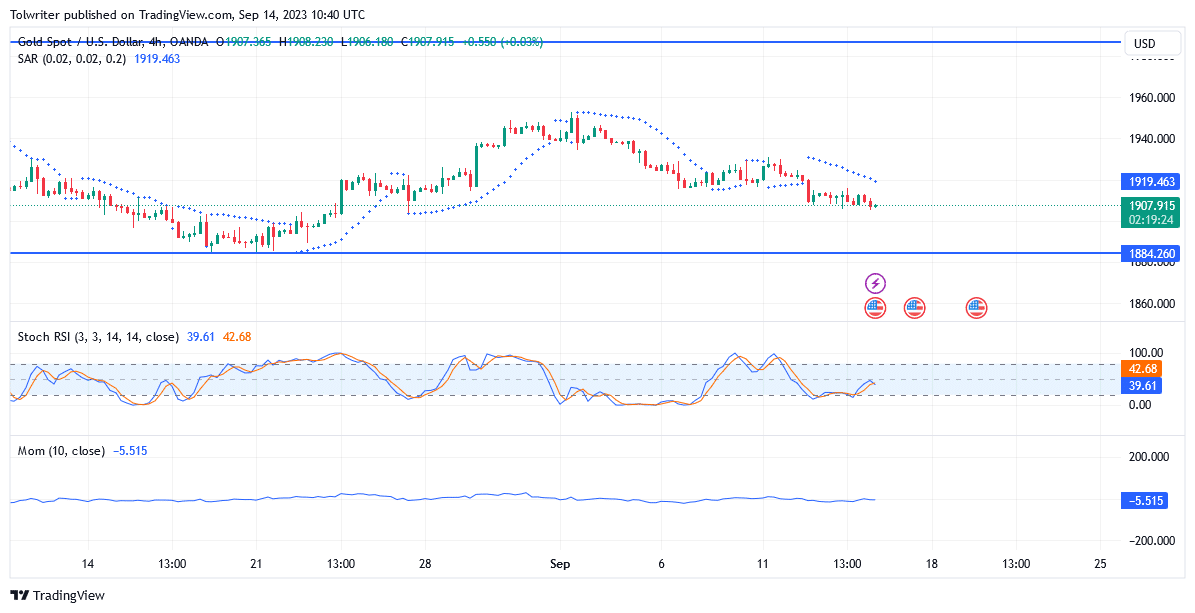

Gold (XAUUSD) Short-Term Trend: Bearish

As sellers inch closer to the 1884.260 key zone, they are gradually losing momentum. It’s worth noting that more selling power will be required for them to effectively close below this significant level. At present, gold seems to lack the volatility needed for a decisive breakout. The market is at a crucial juncture at this time. It will be intriguing to observe how sellers attempt to tip the scales in their favor.